FAQs

Yes, we take data privacy and security seriously. Your financial wellbeing should never come at the cost of your privacy. We ensure this through several layers of protection:

Rigorous regulation

We are regulated by the UK’s Information Commissioner’s Office (ICO). Our commitment to data integrity was recognised with the SPARKies 2023 Data Award, reflecting our privacy-first philosophy.

Industry-leading standards

We partner with regulated leaders like TrueLayer and secure your data on Google Cloud Platform with bank-grade encryption. No human sees your information linked directly to your identity, ensuring it remains unusable in the unlikely event of a breach.

World-class backing

Good With is supported by leading accelerators and institutions including Google for Startups, Barclays Eagle Labs, and NatWest Accelerator, giving us the resources to maintain the highest levels of platform stability and safety.

Industry recognition

Our work has been recognised by leading industry bodies with accolades including the Best Financial Wellbeing App in 2025 (SME News), a Global Fintech for Good in 2024 (Empact Ventures), and Startup of the Year in 2023 (HackerNoon).

Most importantly, we are a team of researchers, scientists, and experts – but we are also people, like you, who care about financial health and understand the challenges.

View our privacy policy or FAQs, or contact us at contact@goodwith.co.

We use your information to create a financial wellbeing profile as unique as you are. By securely adding your bank account data with insights into your money mindset, we ensure your learning is personalised to help you master your money. Whether our models identify patterns of “overthinking” or “splurging”, our science-led approach delivers learning specific to your unique behaviours and needs.

While some questions may feel unconventional, we only collect data that’s absolutely necessary and validated by our research team – nothing more. We follow strict data minimisation and keep your data only for as long as needed to deliver our service.

To set up your account, we also ask for a small amount of personal information, such as your name, email address, date of birth, gender, and postcode. This information is used to verify your account and help us build fair and inclusive products. It is not used to calculate your Readiness Score™.

We share your progress and Readiness Score™ with trusted, FCA-regulated partners only when you give explicit consent. This information is shared securely to help assess and improve our financial health measures and determine which options may be available to you. Giving consent will not affect your credit score, and you can withdraw it at any time by emailing contact@goodwith.co. For more details, please view our privacy policy.

Does the word “budget” make you want to run away? We get it.

That’s why Good With focuses less on what you’re spending and more on why you spend it. Gradual improvement could be a two-minute lesson on spending influences during your commute, or a quick three-minute dive into BNPL on a coffee break before pressing “purchase” on a new jacket. Instead of hours on spreadsheets, the app fits into the gaps in your day, giving you pockets of small wins that add up.

Money is emotional as much as it is practical, which is why we help you explore how your thoughts and feelings shape your spending. Using principles from Cognitive Behavioural Therapy (CBT) and other evidence-based frameworks, Good With helps you identify triggers, challenge anxious thoughts, and build mindful spending habits that last. By changing how you think about money, you develop a healthier, more mindful money practice – step by step.

If money is weighing you down, you’re not alone: 81% of adults in the UK regularly worry about money. When that worry starts to trigger your body’s fight-or-flight response, it can develop into financial anxiety. You may be experiencing it if you notice patterns such as:

• Catastrophising: repeatedly imagining worst-case scenarios

• Avoidance: avoiding your bank balance or ignoring bank notifications

• Sleep disruption: difficulty falling asleep or waking frequently during the night

Financial wellbeing feels like the opposite. It isn't about being “rich”. It’s about the peace of mind that comes from knowing you can handle an unexpected bill or the freedom to enjoy life without guilt. Our mission is to get you there.

Connecting your bank accounts allows us to personalise your learning and provide insights based on your real-time spending patterns. By combining this data with our behavioural models, we can move beyond generic insights to offer guidance tailored specifically to your financial psychology. Our security and privacy safeguards include:

Regulated integration

Your bank authorises the connection through TrueLayer, a secure Open Banking network trusted by over 10 million users and leading UK financial institutions. This partnership ensures your data is handled within a strictly regulated ecosystem.

Read-only access

Our connection is strictly read-only. This safeguard ensures that neither we nor any third parties can access your login details or move funds.

Advanced encryption

We use bank-grade encryption to protect your information at every stage of the process. Even in the unlikely event of a breach, it would be completely unusable.

Data ownership

You remain the sole owner of your information. You can revoke access or request permanent deletion of your data at any time by contacting us at contact@goodwith.co.

Your Readiness Score™ isn’t a credit score – it’s a snapshot of your current relationship with money. Built from the information you share with us, it personalises your learning and tracks your progress over time across areas like your spending habits and money mindset.

Your score shapes your learning journey, guiding you towards greater money confidence without judgement. We call it “readiness” because it reflects how prepared you are to take the next steps with your money, such as credit.

As you progress through your learning path, your score evolves, refreshing each month with your input to keep your learning relevant and up to date.

We get it. Money is boring. But we try to keep things light and airy so you’re never overloaded.

No jargon, no nonsense. Everything in the app fits seamlessly into your every day, so you can find pockets of financial wellbeing in your own time, whenever that works for you.

Exclusive to Lloyds customers

Working with Lloyds to get you credit-confident

Without a credit score, you’re often invisible to banks. Good With’s personalised learning gives you the how-to for building that score.

In exchange, sharing your progress provides Lloyds with the extra context they need to recognise your hard work.

Why Good With works

With just 5 minutes of Good With a day, our learners feel significantly less anxious and more confident with their money.

Built for peace of mind, now you can:

- Make confident money decisions with mental clarity

- Understand your credit in minutes

- Lead the life you actually want to live

Here’s how it works

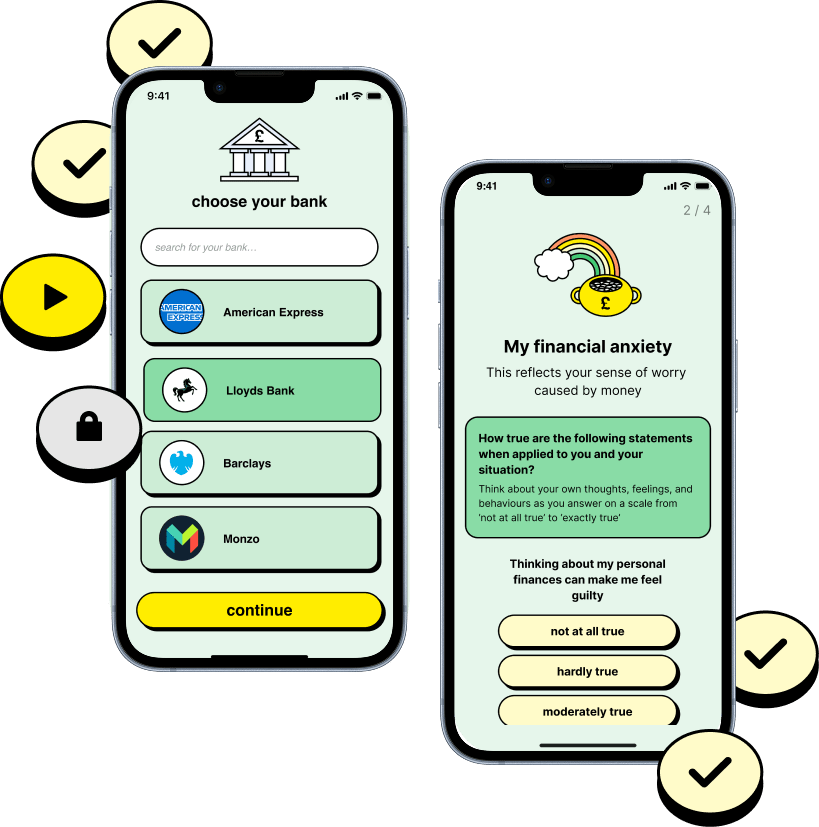

1. Build your profile

Securely hook up your bank accounts and answer science-backed questions to see how your thoughts, feelings, and behaviours influence your spending.

2. Get your Readiness Score™

Not a credit score but your starting point. Use it to understand, build, and prove your readiness for credit.

3. Learn, your way

Good With’s personalised, step-by-step learning approach reduces stress by replacing uncertainty with clear, actionable next steps. Build your confidence, and your score, one small win at a time.

It’s your data, you own it